Powering the Lone Star State: Navigating the Complexities and Opportunities of Texas's Energy Grid

ERCOT charts a course towards a sustainable energy future amidst growing demand and evolving technologies for Texas' independent power grid.

The Texas Energy Structure

The Electric Reliability Council of Texas (ERCOT) is an independent operator that oversees the distribution of electricity to over 26 million customers in Texas, which accounts for approximately 90 percent of the state's total electric demand. It operates as a membership-based 501(c)(4) nonprofit corporation, governed by a board of directors and operates under the regulatory oversight of the Public Utility Commission of Texas (PUCT) and the Texas Legislature. Its membership comprises a diverse group including consumers, cooperatives, generators, power marketers, retail electric providers, investor-owned electric utilities, transmission and distribution providers, and municipally owned electric utilities. Because the Texas power grid is deregulated, no one company controls all of the power plants, transmission lines or distribution network. Therefore, ERCOT’s key responsibility is to coordinate electricity across this diverse network of generating units and transmission lines while also working with Private User Networks.

Benefits and Challenges to Structure

Texas stands out among the states in the United States due to its predominantly independent power grid. This autonomy enables Texas to attract energy investments through its market-oriented policies and evade certain red-tape federal regulations that can prolong response time. However, it also means that Texas must generate almost all the electricity required by its customers within its own borders. The main source of electricity generation is from natural gas. In 2021, the year of the winter freeze that caused a power grid crisis, 42% of energy generated was from natural gas and 19% was from coal.

As an independent power grid, it has inherent risk due to its inability to easily pull from other grids in emergency situations. For example, the winter freeze crisis in February of 2021 was due in large part to the lack of winterization in the natural gas supply and power generation and the subsequent transmission challenges that caused problems in powering the electrical plants. One failure in the system generated other problems in the system which then created a loop that caused other failures, leading to the power grid crisis that caused one of the largest and longest power grid failures in recent Texas history.

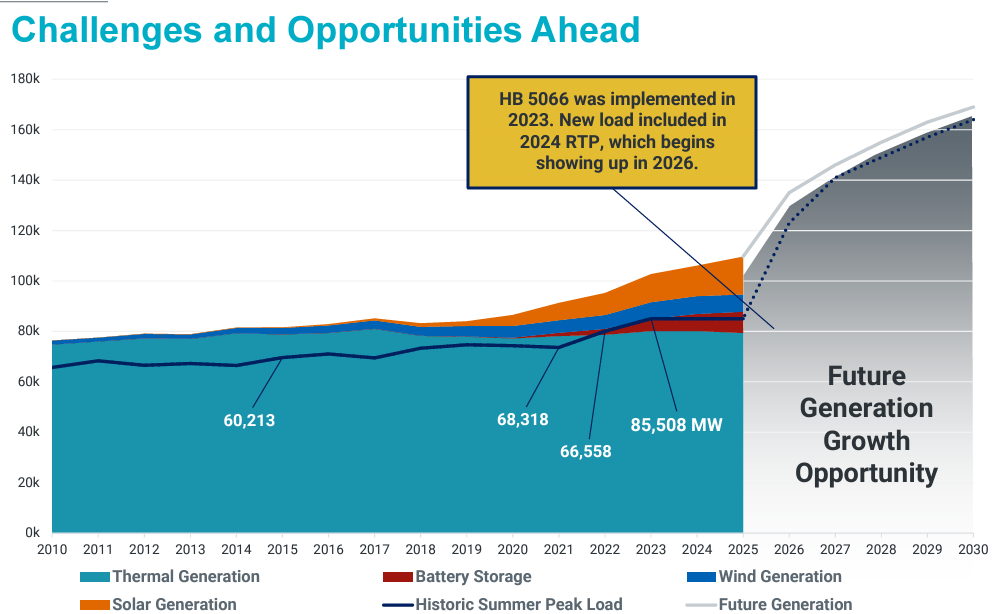

The other challenge with an independent system is that it must find a way to meet all of the demand generated within its domain. With the growing Texas economy and the increased population and more businesses, manufacturing and data centers relocating to Texas, electricity demand has continued to increase. This demand has been exacerbated by a hotter climate with more days of high temperatures, increasing the need for more air conditioning. Between 2005 and 2023, peak power demand in electricity increased by 42%. Within 2020 and 2023 alone, the peak electricity demand increased by 15%. Future demand is now forecasted to increase at an even higher rate.

Keeping up with Demand

Last summer, ERCOT frequently requested energy conservation on critical days due to the recording of several all-time demand peaks, with the highest being 85.7 GW on August 10, 2023. Debate has arisen over the high costs of maintaining reserve power during demand surges. The US Energy Administration estimates that approximately 33% of the current Texas generators that use natural gas and 86% of those that use coal are close to end of life with a typical lifespan of 30-50 years. Such aging power plants also tend to have more maintenance issues, particularly when they are required to operate at higher capacities for longer durations to meet rising electricity demands. Compounding this, the unanticipated hotter weather during typical off-seasons has further limited the time available for power plant operators to conduct necessary maintenance tasks, thus leading to calls for conversation even during off-peak months like we have recently experienced this month in April.

One measure recently passed to address this surge in demand has been the call for the development of new natural gas and coal plants to provide "dispatchable" energy sources for surge demand. Funded by taxpayers, Texans approved a $10 billion loan to construct natural gas plants with provisions to allow costs to be passed down to consumers.

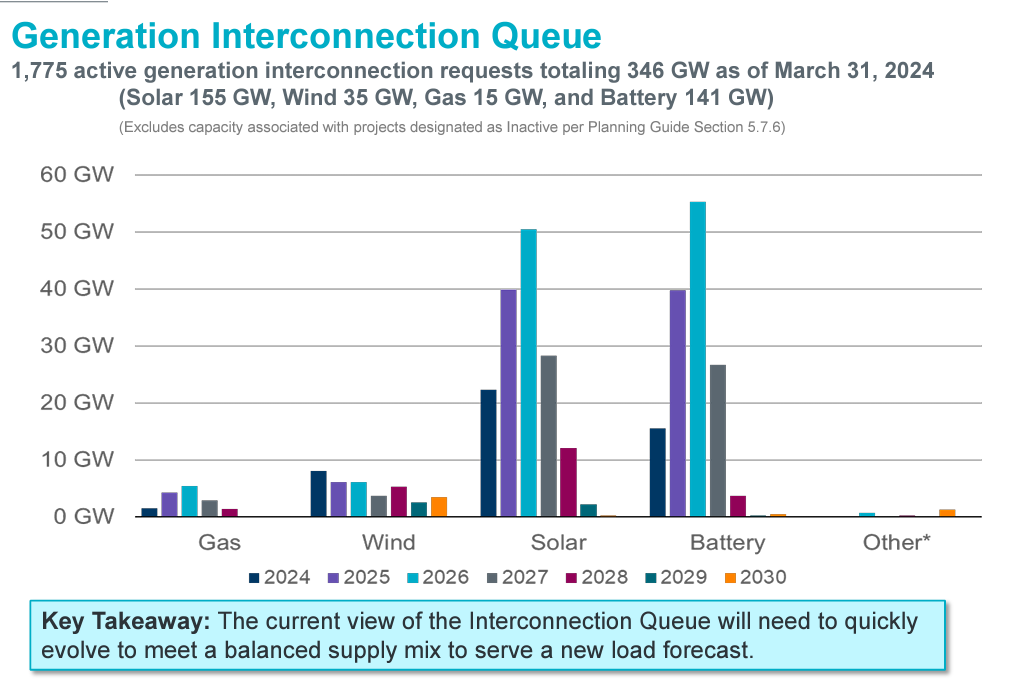

While fossil fuels still make up almost 60% of the electrical power generation, renewable energy has continued to grow in the energy-mix portfolio, with solar going from 4% of the make-up in 2021 to 7.3% in 2023. In fact, Texas now has more solar power capacity than does California; and is on the current trajectory to deploy more battery storage than California by the end of this year. Renewable energy, particularly solar energy, has been attributed for bringing online affordable electricity during peak demand on hot summer days. One reason for the increase in solar energy use is in large part due to a significant drop in price for solar farms and subsequent improvements in battery storage. To date, Texas battery capacity now makes up 23% of all battery power plant capacity in the US.

The increase use of renewable energy, creates new challenges. Renewable energy generation is highly dependent on weather condition, making continuous improvements in utility-scale battery storage essential for increase share of the grid. Another challenge that has become more apparent are the stability of inverters connected to the grid that convert the DC power generated by renewable energy into AC power, the electrical current distributed to consumers. These inverters, especially the older ones, are more susceptible to weather or grid related disturbances which can “trip” the devices offline, thereby disconnecting the electricity from the grid. Such failures have been increasing in number recently, especially in West Texas. According to Ryan Quint, a consultant for Clearway Energy, 90% of the inverter issues can reasonably be resolved with software upgrades. However, some systems may require hardware upgrades which could be very expensive for most developers.

Bracing for the Growth in the Number Data Centers and their Tremendous Thirst for Energy

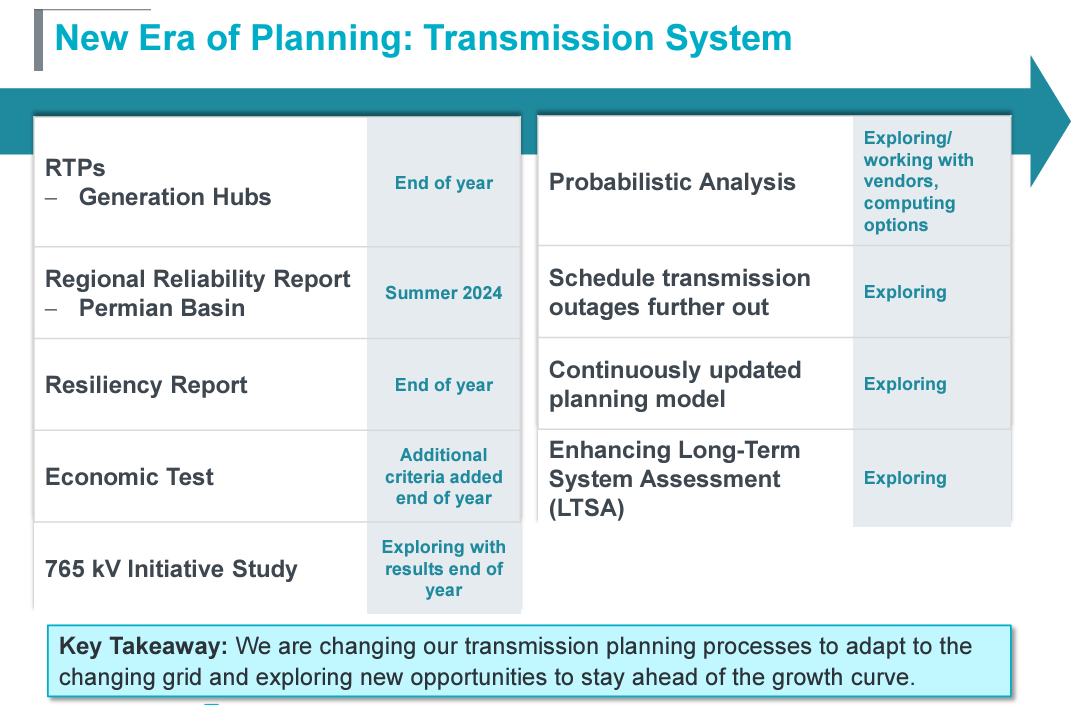

The most recent forecast demand for electricity presented by information Pablo Vegas, the President of ERCOT to the Board of Director in a meeting last week, anticipates that the load demand will increase at a rapid rate to ~42 GW within the next 5-7 years. This unprecedented level of load forecasted continues to be driven by new data centers, crypto mining, hydrogen related manufacturing, a warming climate and population demand. In his presentation, Vegas pointed out that due to the passing of recent legislation and deployment of a more diverse portfolio of energy sources, power plants can be built fast and in more geographically disbursed areas from load centers. However, the biggest bottle neck in meeting demand will be in the speed in adapting and building transmission lines (3-5 years for transmission lines versus 6-12 month for energy generation). To address this, ERCOT is working with stakeholders and incorporating smart grid technology to gain greater visibility as to where and when large load generation growth will occur to better coordinate efforts with Transmission Service Providers (TSPs) to develop efficient distribution processes where it will be needed most.

In conclusion, the Texas energy structure, managed by the Electric Reliability Council of Texas (ERCOT), represents a unique and dynamic system with both benefits and challenges. Its independence allows for market-oriented policies and attracts energy investments which facilitates more rapid deployment of newer technologies to meet growing energy demands. However, it also necessitates careful management to meet the increasing demand and mitigate potential risks. While fossil fuels remain predominant, the growth of renewable energy presents promising opportunities, but not without a new set of challenges, such as grid stability and battery storage limitations. As Texas braces for unprecedented demand growth within the next coming years, initiatives like smart grid technology, increase investment in technological upgrades, increase deployment of renewable energy, and ongoing collaboration with stakeholders to improve transmission systems will be crucial for ensuring reliability and sustainability in the state's energy future. Through these proactive measures and strategic planning, ERCOT aims to navigate the complexities of an evolving energy landscape, securing a resilient and efficient power grid that can withstand the next set of challenges to ensure future economic growth.

Sources:

U.S. Energy Information Administration

ERCOT Board Update, April 24, 2024

ERCOT Yearly Peak Demand records

Houston Chronicle